Mystery Shopping: How Does it Work?

Categories:

Imagine you are one of your account holders stepping into your Financial Institution (FI) for the first time. Were you greeted upon entering? What kind of service did you receive? Were your account needs promptly taken care of? How long did your transactions take? Every interaction, from the moment they enter the branch to the completion of their transaction, shapes your account holders’ perception of your brand.

With account acquisition and retention being a top concern for all FIs, ensuring your FI offers exceptional customer service is not just important but essential. Delivering top-notch customer service can help safeguard your FI.

Competition from Fintech and large national chains increases with each new offering and network expansion.

Increasing competition is only part of the issue. In the US, customer demand for higher levels of service has surged by 43% across all industries. To complicate matters further, almost half (44%) of consumers believe customer service has worsened since COVID-19. Increasing competition, account holders demanding higher levels of service, and worsening customer service form a deadly combo. Controlling competition is not possible. However, you can change and control your customer service completely.

What Makes Delivering Outstanding Customer Service a Challenge?

High staff turnover rates, inadequate training, or misunderstanding of account holder expectations all contribute to the decline in customer service satisfaction. It might be a mix of these issues or something else entirely; for instance, we frequently see an institution investing heavily in marketing campaigns, yet staff are unaware or not clear about the campaign’s offer, incentive, or terms. The only true way to get clarity is through using a powerful tool called mystery shopping. Mystery shopping can equip your team with the insights needed to deliver exceptional service and elevate your FI above the competition.

Using Mystery Shopping to Improve Services

Consider again what your account holders’ experience is like when they visit your FI. Mystery shopping can help provide insights by addressing four crucial areas:

- Identifying Areas for Improvement: Where can your service be enhanced?

- Evaluating Training Effectiveness: Is your training program meeting its goals?

- Assessing Employee Motivation: How engaged and motivated are your staff?

- Gathering Account Holder Feedback: Are you effectively capturing and utilizing account holder feedback?

Understanding these elements is vital for enhancing your service.

- 52% of customers will return to a business if they have a positive experience

- But 59% will leave due to poor service, and 55% of customers who leave will switch to a competitor

These statistics underscore the importance of exceptional service.

By stepping into your account holders’ shoes through mystery shopping, you can gain the insights needed to provide a superior banking experience that keeps account holders coming back. This helps improve your services, boosts employee morale, reduces account holder complaints, and enhances your bottom line. Mystery shopping is a powerful tool that can transform your FI.

The Mechanics of Mystery Shopping

Mystery shopping involves trained evaluators posing as prospective account holders to assess the quality of service your staff provides. These evaluators follow a predetermined script, observing and taking notes on various aspects of their experience. This might include the staff’s attitude, the service’s efficiency, and the overall atmosphere. The insights gathered from these visits can provide a wealth of information that is difficult to obtain through regular feedback channels.

Benefits Beyond the Obvious

While the primary goal of mystery shopping is to improve customer service, the benefits extend beyond just enhancing account holder satisfaction. Here are several additional advantages:

- Enhanced Employee Performance: Regular feedback from mystery shopping can help employees understand their strengths and areas for improvement. Knowing that their performance is monitored can motivate staff to consistently deliver their best. It’s critical, though, that those shopping results be reviewed with employees in a positive way as a coaching and training tool versus a punitive approach that creates stress or job dissatisfaction.

Around 80% of employees believe training is beneficial to their productivity.

- Effective Training Programs: By identifying areas where employees struggle, you can tailor your training programs to address these weaknesses. This targeted approach ensures that training is relevant and effective.

59% of employees who have received training believe it improves their performance.

- Increased Account Holder Loyalty: Account holders’ loyalty to your FI grows when they consistently receive excellent service.

Loyal account holders are more likely to return and are 38% more likely to recommend your services to others.

- Proactive Problem Solving: Mystery shopping can help you identify potential issues before they escalate into major problems. By addressing these issues promptly, you can prevent account holder dissatisfaction and potential loss of business.

According to 59% of customers, it only takes one bad experience for account holders to never return.

- Benchmarking Performance: Mystery shopping allows you to benchmark your performance against industry standards and competitors. This comparative analysis can provide valuable insights into where you stand and what improvements are needed to stay ahead.

Our Approach to a Client with 5 Branches

Our mystery shopping evaluator conducted 15 assessments across a network of 5 branches for a valued client over the course of a month. Deliberately distributing the evaluations over a month helped provide more accurate samples for the data collected. By adopting this approach, we could speak with a diverse array of employees across multiple locations, thereby giving a more accurate portrayal of standard customer service within the branches. Each assessment included over 30 specific questions that the client could score and comment on.

The goal of the Mystery Shop is to understand how the staff handled questions about a recently launched campaign targeting new possible checking customers with a Free Rewards Checking account and a $50 bonus.

We evaluated the employees based on certain criteria, such as:

- Greeting and initial impression

- Knowledge and professionalism

- Problem resolution skills

- Transaction efficiency

- Overall experience

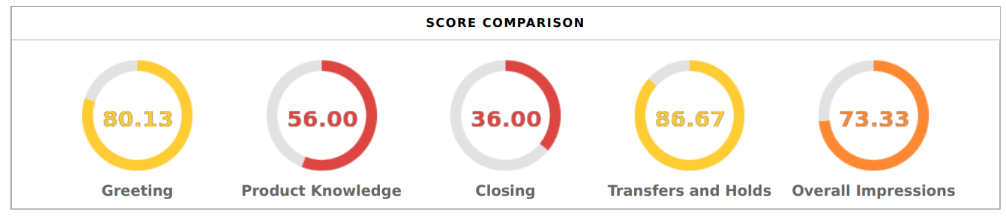

Our evaluation found that employees excelled at greeting and handling transfers or holds but faced challenges with product knowledge and closing. Following our evaluation, we provided our client with a detailed report showcasing the data we collected and offered recommendations on enhancing their overall score. Our approach highlights and ranks which branches provide the best customer service and identifies areas for improvement. In addition, results were also broken out by individual questions to allow us to pinpoint the strengths and weaknesses.

During this shop, it was discovered that in only 15% of the calls, staff mentioned the $50 bonus to a shopper when inquiring about a new checking account. This was a wasted opportunity not to disclose the $50 bonus to entice the prospect of opening a new account. Other observations made during the mystery shop included:

- Closing: When wrapping up a phone call, the staff scored very low on solidifying the next step in opening the account either in or online.

- Checking Rewards: There was some confusion about what rewards were available for the prospect and how to qualify to receive the rewards.

- Engagement: Staff were much more comfortable answering questions than asking the prospective questions about their banking needs.

Once ADVANTAGE reviewed the results with the client, we were able to make strong training recommendations for staff before the next marketing campaign was launched. Already, we have seen a big increase in discussions around the $50 bonus to generate excitement when a prospecting opportunity arises.

Conclusion

Mystery shopping is a powerful tool that can transform how your financial institution delivers customer service. By stepping into your account holders’ shoes, you gain invaluable insights into their experiences and can make targeted improvements that set your institution apart from the competition.

It’s critical to partner with a mystery shop provider that understands the nuances of setting up the script, training the callers, and reporting the results. Equally important is finding a provider that understands the banking industry and can utilize those results to provide insights and training to help your staff optimize opportunities with new and existing account holders.

In a world where account holder expectations are constantly evolving, staying attuned to their needs and delivering exceptional service is not just an advantage; it’s a necessity. Embrace mystery shopping as a strategic approach to elevate your financial institution’s service quality, foster account holder loyalty, and ensure long-term success.

==================================================================

For more on this topic, check out our webinar, Maximizing Market Share and Checking Accounts in Today’s Competitive Landscape

Contact your local representative to learn more about what we offer or how to receive a complimentary evaluation.

About ADVANTAGE, powered by JMFA

ADVANTAGE is a leading provider of consultation services for credit unions and community banks. With a long-standing 40-year history of excellence, we help our clients navigate the ever-changing financial landscape, providing solutions that give them a competitive advantage. Our services include account acquisition, overdraft compliance consulting, contract negotiation, and technology strategy and selection. From growing market share and improving non-interest income to contract negotiations and technology strategy, our experts offer you and your account holders the best solutions.

To subscribe to our news and updates, visit advantage-fi.com/newsletter.