Overdraft in the Age of AI: Is Your Bias Showing?

Categories:

Your Overdraft Program may not be as “Fair” as you Think

Providing overdraft services that truly meet consumer needs is more critical than ever. The pandemic has accelerated the adoption of advanced technologies—such as artificial intelligence (AI) and machine learning (ML)—into service delivery strategies, reshaping consumer expectations and heightening fintech competition. While these technologies can offer significant benefits, they also come with challenges.

Providing Valuable Overdraft Services

While more advanced technology that analyzes previous account activity can help detect fraud and predict ideal consumer services, it poses a significant risk. Relying on analytics or algorithms to determine who receives a specific service, like overdraft protection, contradicts regulatory expectations of fairness. This erodes consumer trust and raises serious concerns about potential algorithmic bias. Addressing this issue is crucial to maintaining consumer trust and regulatory compliance.

CFPB Director Rohit Chopra has highlighted concerns about the potential misuse of opaque algorithms, pointing out that while local banks prioritize customer service and personal relationships, larger banks have shifted towards automated, impersonal systems. Chopra emphasized that without transparency in how algorithms make decisions, consumers and regulators cannot ensure a fair, unbiased market.

Listening to the Overdraft Needs of the Account Holder

Community banks and credit unions can learn a lot by listening directly to those using overdraft services. Being open to hearing account holder feedback and collecting feedback is not just a game changer; it’s necessary for your financial institution. When you listen and tailor your services to your account holders’ needs, you empower them and demonstrate a more customer-centric approach to your overdraft program.

With increased attention on inclusive consumer services, maintaining an unbiased overdraft solution that keeps account holders well-informed about their options and account status is essential.

Unlike complicated algorithms or matrix-based programs that utilize data points to determine program limits unknown to the consumer, a fully transparent overdraft solution is built around processes and procedures that include all eligible account holders and are continually communicated. With full knowledge of their limit, program fees, and the alternative services available, they can maintain their finances without worry when an unexpected expense or emergency knocks them off track.

Based on financial well-being and financial literacy, a completely disclosed overdraft strategy is a win-win for account holders and financial institutions. Plus, with the support of experienced consultants and compliance experts, you can uncover many aspects of your program that need improving to achieve the best results, including:

- An appropriate fee structure and guidance on making suitable adjustments.

- Established limits and clearly defined rules that help consumers make responsible and informed decisions about service usage.

- Recommendations on overdraft threshold (de minimis), daily caps, grace periods, and fee refunds.

- Expert reviews of current disclosures and advice regarding effectively explaining important account information.

- Comprehensive staff training on how to educate account holders about your program.

- Compliant policies, procedures, and communications materials.

- Ongoing, proactive performance and compliance recommendations.

- The only written, 100% compliance guarantee in the industry.

Overdraft Protection and AI

AI and machine learning are transforming financial services by analyzing vast amounts of data to detect fraud and predict optimal consumer services. Generative AI in banking is also transforming fraud detection and risk management. By analyzing vast amounts of transaction data, AI models can identify unusual patterns that might indicate fraudulent activities. This proactive approach enables banks to mitigate risks more effectively, safeguarding customer assets.

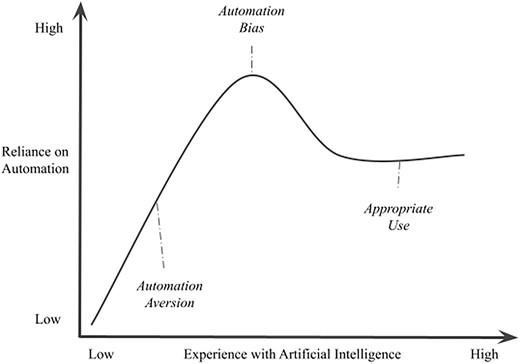

While using AI applications, data privacy and compliance with regulatory requirements are crucial for maintaining customer trust and meeting industry standards. However, these systems can inadvertently create bias. Ensuring fairness in AI requires a commitment to ethical practices. Techniques like supervised learning, where algorithms learn from labeled datasets, can reflect and amplify existing biases if the data does not represent the diverse consumer base. Essential steps include regularly auditing algorithms, using diverse training data, and involving multidisciplinary teams in the development process. By adopting these practices, financial institutions can mitigate bias and build trust with account holders.

Navigating the Regulatory Landscape of AI

Regulatory bodies are increasingly focused on the use of AI in financial services. The Consumer Financial Protection Bureau (CFPB) has raised concerns about the transparency and fairness of algorithmic decisions. Staying informed about regulations and actively seeking compliance will protect consumers and shield institutions from legal repercussions.

Future Trends and Innovations

The future of AI in financial services is promising. Innovations such as explainable AI, which makes decision-making processes transparent, and federated learning, which allows algorithms to learn from decentralized data, pave the way for more equitable financial solutions. Staying ahead of these trends can help institutions remain competitive and fair. However, the growing sophistication of AI is challenging model risk managers when it comes to explaining the technology and its implications for risk management and regulatory compliance. As a result, more thorough investigation and testing are necessary.

Implementing Fair Overdraft Programs

Financial institutions must proactively ensure their overdraft programs are unbiased and transparent. Here’s a quick roadmap:

- Review and Adjust Fee Structures: Ensure fair and reasonable fees.

- Set Clear Limits and Rules: Help account holders make informed decisions.

- Regularly Audit Algorithms: Identify and correct biases.

- Enhance Disclosures: Clearly explain account terms and conditions.

- Train Staff: Equip them to educate consumers effectively.

- Engage Compliance Experts: Continuously improve program performance and compliance.

Nothing to Hide and Plenty to Gain

Fair and transparent overdraft programs can significantly enhance financial inclusion, providing underserved communities better access to financial services. Financial institutions can support broader social and economic well-being by focusing on ethical AI and inclusive practices.

Regulators are vigilant about protecting consumers from biased financial practices. By offering transparent, inclusive overdraft options, financial institutions can avoid scrutiny, maintain a sustainable income source, and build long-term trust and loyalty. Helping consumers manage their short-term financial needs with certainty is not just a regulatory requirement; it’s a business imperative and a social good.

To learn more about staying ahead of compliance challenges, watch our latest webinar, “Overdraft Outlook: Safeguarding Your Future.”

Contact your local representative to learn more about what we offer or how to receive a complimentary evaluation.

About ADVANTAGE, powered by JMFA

ADVANTAGE is a leading provider of consultation services for credit unions and community banks. With a long-standing 40-year history of excellence, we help our clients navigate the ever-changing financial landscape, providing solutions that give them a competitive advantage. Our services include account acquisition, overdraft compliance consulting, contract negotiation, and technology strategy and selection. From growing market share and improving non-interest income to contract negotiations and technology strategy, our experts offer you and your account holders the best solutions.

To subscribe to our news and updates, visit advantage-fi.com/newsletter.