Who Really Uses Overdraft Services? The Surprising Reality

Categories:

Consumers rely on overdraft services to manage unexpected expenses across all income levels and demographics. Yet, community banks and credit unions, committed to putting people first, sometimes overlook how many of their account holders would benefit from access to a reliable overdraft service.

We’ve all experienced times when we’ve needed a bit of extra support. Whether it’s to pay a bill before payday or due to an unexpected expense, having access to dependable overdraft services can be a critical lifeline. When the transaction is covered by overdraft services, it acts as a financial safety net, sparing account holders the embarrassment of a declined transaction or the stress of missing a payment.

Overdraft Services Benefit a Diverse Range of Account Holders

When it comes to overdrafts, many assume these services mainly support financially vulnerable individuals. However, recent data challenges this view, revealing that a substantial number of higher-income individuals also feel financially strained. For instance:

- A recent Forbes study shows that a surprising number of millennials earning over $200,000 annually are living paycheck to paycheck.

- Similarly, a MarketWatch Guides survey found that 66.2% of Americans, across all income levels, feel they’re living paycheck to paycheck.

This reality may be unexpected, but it reflects how a significant portion of Americans are navigating financial pressures. As a result, many consumers could benefit from overdraft protection when they encounter cash flow challenges. Are your account holders turning to a payday lender or, in the best case, one of their credit cards when strapped for cash? Do they know about the overdraft options that are available to them?

Overdraft Use Spans Generations and Income Brackets

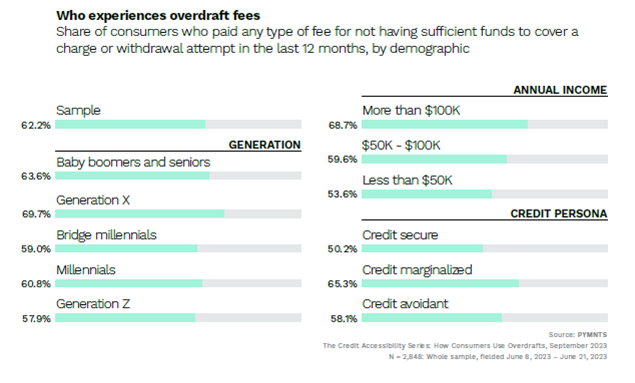

Additional insights from The Credit Accessibility Series: How Consumers Use Overdrafts reveal that overdraft use extends across different income levels and generations. For example

- Gen X leads in overdraft use, with 70% of those who overdrew and incurred fees.

- Baby Boomers follow closely at 62%, with Millennials and bridge millennials at approximately 61% and 59%, respectively.

- Generation Z also shows significant usage at 58%, underscoring that overdraft services serve a wide demographic.

When looking at income, 69% of high-income consumers earning over $100,000 annually who overdrew paid fees, compared to 54% of those earning less than $50,000. These stats further challenge the misconception that overdraft services are primarily for low-income individuals. By understanding the diverse needs of their account holders, banks and credit unions can better support a range of consumers who may benefit from overdraft protection.

A Consumer-First Overdraft Program Aligns with Community Banking Values

Community banks and credit unions are dedicated to building lasting relationships within their local communities, offering personalized services that demonstrate an understanding of their account holders’ lives and challenges. They are committed to putting people first by providing services that genuinely meet their account holders’ needs.

A transparent, consumer-first overdraft program aligns perfectly with this mission. It’s about extending a consumer-focused philosophy across all account services. When designed with transparency, fairness, and value in mind, overdraft privilege becomes a trusted resource that consumers can rely on. When they recognize the value and understand the benefits, they’re more likely to see it as a dependable option for managing unexpected expenses.

Partnering with a Trusted Expert Ensures Compliance and Quality Service

Not all overdraft vendors offer a solution as fair and equitable as they may claim. Navigating the current regulatory landscape and evolving compliance shifts can be challenging. Working with a trusted partner can make all the difference. With over 40 years of experience, ADVANTAGE is a leading overdraft program provider with in-depth expertise in state and federal requirements, ensuring compliance with the latest standards.

Beyond compliance, customized frontline staff training is essential for empowering frontline staff to communicate effectively and improving the overdraft experience for account holders.

The Opportunity to Build Trust and Loyalty

Overdraft protection services are a valuable safety net for a diverse range of account holders across all income levels. From financially vulnerable individuals to high-earning professionals, many rely on these services to manage unexpected expenses. By offering a consumer-first overdraft program, community banks and credit unions can provide real value to their account holders, building trust and fostering loyalty.

As regulatory guidance continues to evolve, financial institutions have an opportunity to reframe the narrative around overdraft services, ensuring that all consumers—regardless of financial standing—have access to transparent, compliant, and user-friendly overdraft options. A well-designed program provides more than financial support; it strengthens the connection between your financial institution and your community.

Ready to enhance your overdraft program?

ADVANTAGE can help you deliver a solution that strengthens account holder trust while meeting regulatory standards. Let us partner with you to create an overdraft program that supports your account holders and reinforces your community-centered values.

For more on this topic, check out our webinar, “A Consumer-First Approach to Overdrafts.”

Contact your local representative to learn more about offering a consumer-first overdraft privilege program.

About ADVANTAGE, powered by JMFA

ADVANTAGE empowers community financial institutions with strategic solutions to drive growth and success. Our comprehensive services include overdraft program compliance, account acquisition strategies, contract negotiation expertise, and technology strategy consulting. With 40-plus years of supporting community banks and credit unions nationwide, we’re dedicated to delivering exceptional results and fostering long-term partnerships. Choose ADVANTAGE to enhance performance, unlock new opportunities, and build lasting value.

Stay connected with our latest insights by subscribing—visit advantage-fi.com/newsletter.