Why DIY Overdraft Programs Fall Flat

Categories:

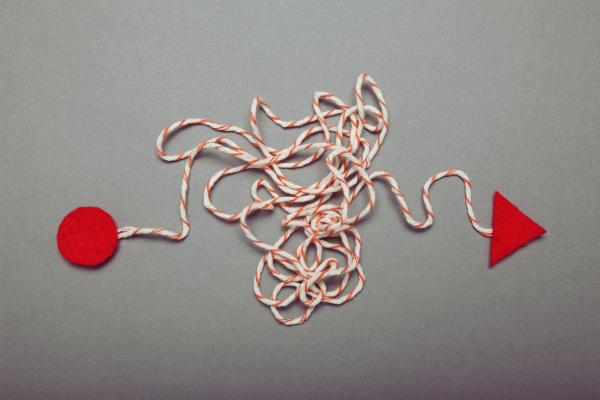

Handling overdrafts and NSF (Non-Sufficient Funds) remains a supervisory priority. Discover five compelling reasons why choosing a do-it-yourself (DIY) strategy could lead to underperformance.

Is your overdraft program on autopilot? Does it rely solely on the functionality of your core processor? Are you confident that your financial institution is compliant with UDAAP practices when it comes to handling overdrafts and NSFs? Your core may give you the technical abilities, but it likely misses the mark when it comes to delivering the type of expert guidance, training, monitoring, and customization necessary to offer a consumer-friendly and compliant program that will lead to sustainable growth and long-term results.

A consulting partner with compliance experience can put your program and strategy on the right track and keep it there. Working with a partner can provide ongoing returns for your investment, including a responsible service your account holders can depend on, with numerous benefits that add up to undeniable value.

Here are five ways you could be missing out if you’re managing a DIY overdraft program:

1. An Objective Roadmap for Success

Over a period of time, in-house management can sometimes lead to complacency or oversight. A consultant brings an objective, fresh perspective. They are capable of quickly identifying and addressing overlooked issues in your day-to-day operations. Whether it’s procedural missteps, unclear disclosure language, unreported data, or compliance risks, their insight provides a roadmap for success, guiding your financial institution to a higher level of performance. You’ll benefit from knowing where there’s room for improvement and an effective plan of attack.

2. A Customized Solution to Meet Your Needs

Often, there’s the misconception that using a consultant is one-size-fits-all advice. With an expert on your side, you can share your unique goals, challenges, and needs, resulting in a tailored program. You also gain comprehensive data analysis and trend monitoring to ensure your strategy evolves to remain perfectly aligned with your particular requirements.

3. Access to Compliance Expertise

While your core application may do the job, it frequently lacks the actionable compliance guidance required to stay ahead of the ever-evolving examiner scrutiny and align with consumer expectations. Whether it’s addressing the intricacies of how to handle re-presentment and authorize positive/settle negative transactions, or clearly disclosing the details of your program, partnering with a consultant provides you with the invaluable benefit of robust compliance resources that bolster your confidence in processes and procedures.

Moreover, your collaboration with a consultant should come with the assurance of a compliance guarantee and access to useful resources, offering you an extra layer of security and peace of mind. This ensures that you remain well-prepared and equipped to effectively mitigate risks, staying proactive in a regulatory environment that is constantly shifting.

4. Specialized Insights and Shared Knowledge

You can review the overdraft reports your core provides, but it’s important to see beyond the surface. A specialist provides more advanced analytics to complement their proficiencies in analyzing trends and key performance indicators. Having a dedicated expert monitoring your program regularly provides a much-needed advantage. Plus, by leveraging their insights from a wealth of experiences and projects, you’ll have a team offering impactful recommendations for continuous growth and improvement, unlocking the true potential of your program.

5. Comprehensive Training Resources

Say goodbye to expensive webinars and conferences that may not fully address your financial institution’s specific needs. You should expect to receive a well-rounded training plan and resources crafted by experienced trainers. From in-person to on-demand training, receiving ongoing educational options to fit your staff needs offers much more value. This ensures your staff possesses the knowledge and confidence to explain your overdraft service to account holders effectively and consistently.

In the ever-evolving financial landscape, embracing the expertise of a consultant isn’t just about staying competitive; it’s about setting your institution on a path of unwavering success. Invest in the insights, experience, and knowledge that only a consultant can bring to your overdraft program and watch not only your institution but also your account holders thrive with confidence.

Check out our webinar “Overdraft Litigation: Evaluating Your Risk Factors” now available on-demand.

Discover how ADVANTAGE can elevate your overdraft program. Get in touch today by calling 800-809-2307 or request a complimentary program evaluation.