Your account holders need your support. Are you up to the task?

Categories:

The beginning of a new year is a time of renewal. It’s also when many of the holiday bills arrive. A few weeks of overspending can create financial stress and pressure for months. One way you can help your account holders is to offer a reliable financial safety net. Having access to this type of option provides peace of mind, should they need it. Is your overdraft program in top form?

Financial instability for many households

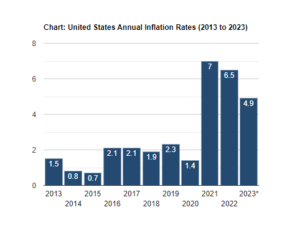

Under the National Bureau of Economic Research’s definition, we were not in a recession in 2022 and we still aren’t now. However, inflation and rising interest rates have caused financial struggles for many.

While yearly rent growth has been decelerating for eight months now, the US experienced nearly a year of double digit increases, and the national median rent is now $1,967. Over the past 2 years, egg prices have nearly doubled, leading some consumers to extreme workarounds like trying to smuggle eggs from Mexico and painting “Easter potatoes” instead of dying eggs, to save on household funds. Meat, fish and chicken are all substantially pricier than they were two years ago, as well as cereal and bread, which cost nearly 25% more today than they did in 2021.

The U.S. personal savings rate remains below its historical average

According to the U.S. Bureau of Economic Analysis, the seasonally adjusted annual rate of personal saving was 4.6% in February. That’s well below the average annual rate of 8.9%. It’s no surprise that 46% of Americans are investing and saving less than usual. According to a recent holiday debt report, 35% took on holiday debt this past December. That means zero or negative balances can be expected as holiday bills, annual property taxes or fees come due.

Overdraft as a safety net for account holders

Consumers do not try to overdraw their account, and no one likes to live paycheck to paycheck. But it happens. And it’s happening now for many, as bills, inflation, and balances catch up with everyday expenses. The best thing you can do is have multiple methods of support—like a fully disclosed overdraft service—to help account holders maintain financial health. A one-time overdraft charge is more appealing than having an important payment declined, being assessed late fees, and risk lowering your credit score.

We know that 9 out of 10 adults find overdraft protection valuable. And we’ve seen financial institutions achieve positive outcomes when providing a fully disclosed overdraft program.

Are you offering an overdraft service that your account holders can rely on? Is it transparent, fair, compliant and easy to understand?

A consumer-friendly overdraft program is the safety net that your account holders may need and will appreciate having the option available. Consumer-friendly means transparent, fair, compliant and easy to understand.

- Transparent – fully disclosed so your account holders know how the service works, including their limit and fees for using it

- Fair – the fee assessed is in line with the amount of the overdraft

- Compliant – adheres to all regulatory rules and best practices meant to protect consumers

- Easy to understand – account holders know what to expect if they decide to use the service.

Be proactive with your disclosures and prioritize the consumer

If you’re unsure whether your program meets the consumer-friendly standards, take a look at your strategy to determine if there is a need to make changes. Evaluating, diagnosing and implementing improvements is the easiest way to get your overdraft program back on track.

Keeping your goals, your market and how your account holders currently utilize it in mind, ask yourself:

- Are our fee amounts reasonable?

- Do we offer an overdraft threshold (de minimis) to ensure account holders don’t get charged a fee unreasonably?

- Do we have an appropriate daily cap on fees?

- Do we offer a grace period that allows account holders to bring their account positive and avoid a fee?

- Are our service disclosures clear, updated, and readily available?

- Is our communication transparent and easy to understand?

- Does our staff receive the training necessary to properly explain the service?

- Do we have the right resources and tools to run an effective and responsible program?

Make sure you’re ready for what may be a challenging time for your account holders. Redefining your overdraft strategy will ensure you can deliver on your mission to promote financial health and well-being for them. Now is the perfect time to put your plan in place.

To learn more about how you can offer a responsible, compliant service that offers value to your account holders, contact the experts at JMFA or download our whitepaper, “Does Your Overdraft Program Check All The Boxes?”