Categories

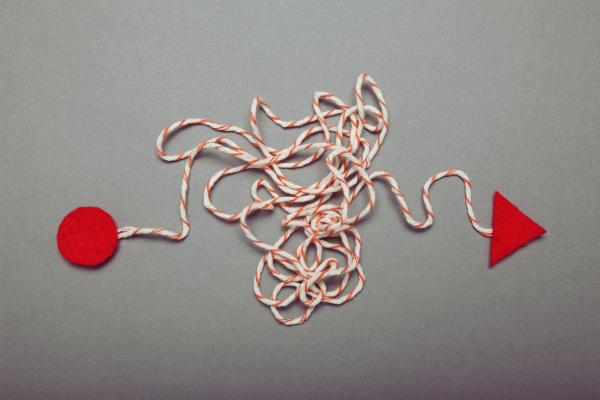

Navigating the evolving overdraft regulatory landscape

As regulatory scrutiny intensifies, learn more about what examiners are focused on, strategies to reduce consumer costs, and how to ensure fair overdraft fee practices.

Empower Your Front-line Staff Through Comprehensive Training

Credit unions and community banks play a vital role in supporting communities financially. To ensure that you can fulfill this mission effectively, it's essential to ...

Does Your Overdraft Program Check All The Boxes?

From regulatory scrutiny and class-action lawsuits to media coverage and legislative efforts, overdraft programs have received much attention recently. Community banks and credit unions are ...

JMFA Announces Rebranding and Expansion of Consultation Services

JMFA, a leading provider of financial services consultation, is thrilled to announce a significant milestone in its evolution. As part of our commitment to better ...

Why DIY Overdraft Programs Fall Flat

Handling overdrafts and NSF (Non-Sufficient Funds) remains a supervisory priority. Discover five compelling reasons why choosing a do-it-yourself (DIY) strategy could lead to underperformance. Is ...

Exciting Insights from the Latest ABA Survey on Overdraft Services

The American Bankers Association released a new survey offering insights into consumers' perceptions of and value of overdraft services. Learn five key takeaways from the ...

Avoid risks with your overdraft program by acting now

Despite no new guidance from the CFPB, regulators are emphasizing the need to evaluate and review overdraft services. Is yours up to date with the ...

Algorithm-based overdraft protection lacks disclosure and transparency

Learn why algorithm-based overdraft programs are risky business for financial institutions and their account holders — and why full disclosure, transparency, and fixed limits comply ...

Is it time to evaluate your overdraft program disclosures?

If you think your overdraft disclosures only need to be reviewed after new rules or guidance is issued, you could be caught off guard by ...